Brasil Bitcoin uses cookies with the aim of improving your experience on our website and adapting the content to make it more useful and accessible.

For more information, see our cookie policy.

Earn money

Cryptocurrency solutions

For you

Cryptocurrency solutions

Your business in the economic future

For your company

🤖 Ative a SophIA Plus: sua assessora cripto

Bitcoin had a reduction in its issuance, bringing greater scarcity to the currency, understand how this will impact your investments.

The Bitcoin Halving is an event that halves miners’ rewards, directly affecting the issuance of the cryptocurrency. With the 2024 Halving now complete, the reward has dropped to 3,125 bitcoins per block, intensifying the currency’s scarcity and potentially its market value.

This event, which occurs every 210,000 blocks, is a pillar in the Bitcoin economy as it adjusts scheduled inflation and impacts supply. With Halvings expected to continue, they are expected to influence supply and demand dynamics until the last bitcoin is issued.

Projected to end around 2140, the Halving cycle will continue until the maximum limit of 21 million bitcoins is reached. After this, there will be no further issuance of bitcoins, completing the deflationary and scarcity design predefined by Bitcoin creator Satoshi Nakamoto.

In November 2012, after the first halving, Bitcoin saw an increase of over 9,900% in the following year, marking the beginning of its upward journey.

The second halving in July 2016 led to a price increase of around 300% in one year, consolidating Bitcoin as a serious asset in the financial market.

Following the May 2020 halving, Bitcoin witnessed a monumental jump of over 500% in one year, highlighting its resilience and attraction as a safe-haven asset.

The Bitcoin Halving is an event that halves miners’ rewards, directly affecting the issuance of the cryptocurrency. With the 2024 Halving now complete, the reward has dropped to 3,125 bitcoins per block, intensifying the currency’s scarcity and potentially its market value.

This event, which occurs every 210,000 blocks, is a pillar in the Bitcoin economy as it adjusts scheduled inflation and impacts supply. With Halvings expected to continue, they are expected to influence supply and demand dynamics until the last bitcoin is issued.

Projected to end around 2140, the Halving cycle will continue until the maximum limit of 21 million bitcoins is reached. After this, there will be no further issuance of bitcoins, completing the deflationary and scarcity design predefined by Bitcoin creator Satoshi Nakamoto.

Bitcoin price on Halving day

R$ 334.032,98

Current Bitcoin Price

R$ 352.782,60

Variation

+5,61%

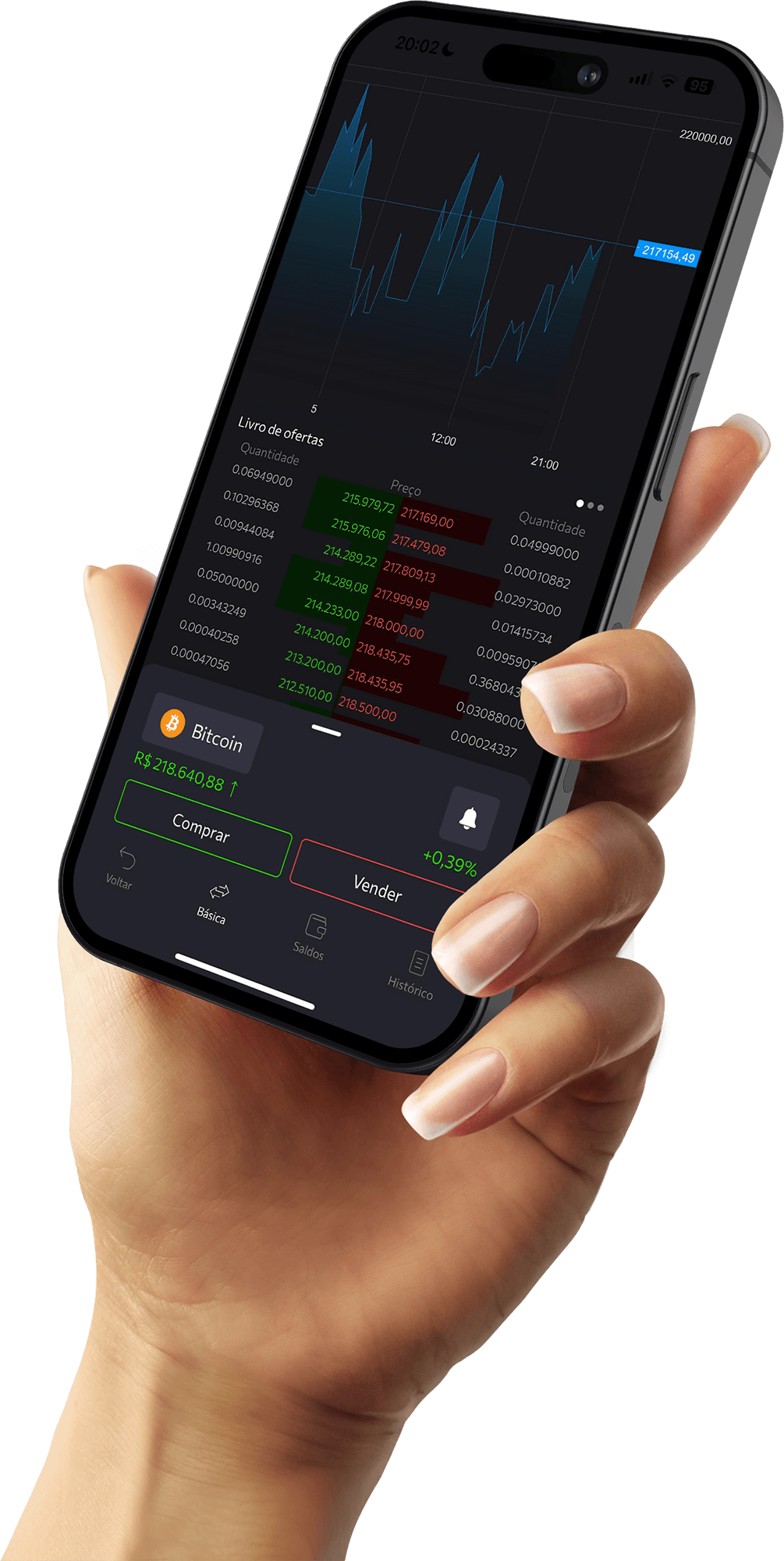

Trust the platform chosen by more than 420 thousand Brazilian clients, who have already traded more than R$3.5 billion.

Brasil Bitcoin has the best rating in the crypto world on the App Store, Google Play and Reclame Aqui.

We serve beginners to experts, count on a complete platform and humanized service.